does td ameritrade report to irs

Opinion or advice regarding securities or markets contained in such material does not reflect the views of TD Ameritrade and TD Ameritrade does not verify any information included in such material. OANDA does not report taxes on behalf of our clients and as a result we do not provide any tax forms relating to profitloss on your account eg.

Td Ameritrade Capital Gains Taxes Explained Facebook

Intraday data is delayed at least 20 minutes.

. Box 2e - Section 897 ordinary dividends. Prior to 2011 firms such as TD Ameritrade reported only sale proceeds. When you buy or sell an asset you have to report to the IRS on your Form 1040.

But they do report the basis and sale price. What you need to report to the IRS. Interest Income Form 1099-INT reports all interest payments such as bond interest.

TD AMERITRADE uses the following forms to report income and securities transactions to the IRS. TD Ameritrade does not report this income to the IRS. You will report that the distribution was a QCD on your IRS 1040 tax form when you file your taxes.

TD Ameritrade does not provide this form. Open an Account Now. TD Ameritrade does not report this income to the IRS.

Best Broker for Beginners and Best Broker for Mobile. The cost basis information TD Ameritrade provides for tax-exempt accounts is for client use only. Tracking your cost-basis To figure out your gainloss you need to know the original value of the asset or cost basis including adjustments such as sales commissions or transaction fees.

I recently opened an account with TD Ameritrade. TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. Regardless of whether you withdrew money from your account or not.

This amount should already account for any fees or sales expenses charged by your broker. If you have any questions regarding your Consolidated 1099. Options that differ in strike or expiration date can not create a wash sale.

The IRS treats virtual currencies as property which means theyre taxed similarly to stocks. A Consolidated 1099 Form which consists of. However TD Ameritrade does not report this income to the IRS.

The IRS has updated the 2021 Form 1099-DIV to include two new boxes. INT 1099-OID and 1099-MISC Boxes 2 and 8. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative.

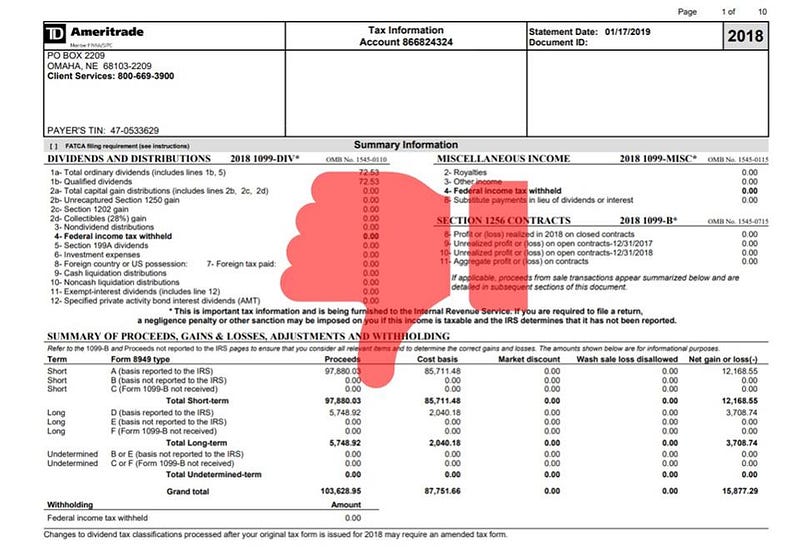

Information in the Supplemental Information Section of the Consolidated 1099 Form is provided for your convenience only. What if I have multiple Qualified Retirement Plans. Your TD Ameritrade Consolidated Form 1099 Weve consolidated five separate 1099 forms into one comprehensive form containing information we report to the IRS.

The IRS requires that TD Ameritrade report your QCD payment on IRS Form 1099R as a distribution. Best Broker for Options and Best Broker for Low Costs. They dont report the gain or loss to the IRS.

I believe they report columns 1a through 1f on forms 8949 the gain or loss is calculated on column 1g. I just confirmed with TD ameritrade that Brokers do not remove wash sales from 1099b when the security is sold disposed and never trades in the last two month of the year. If you use tax software we can help you either 1 import your data into HR Block.

Shows the portion of the amount in. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. Calls are different than puts.

However if you have other reportable information these amounts will still be listed on the 1099-MISC as a courtesy to assist you in reporting these payments on your personal tax return. Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls around. Box 2e and Box 2f.

It is up to the prudent investortrader to remove these wash sales so the loss can be used to offset the gain from another trades. TD Ameritrade does not report this income to the IRS. If you have other sales expenses not included in the Box 2a total check the box I paid sales.

TD Ameritrade will report a dividend as qualified if it has been paid by a US. The form covers the following areas. Ask Your Own Tax Question.

And Accretive Capital LLC are separate. GainsKeeper service and performance reporting is offered and conducted by Wolters Kluwer Financial Services Inc. Your Consolidated Form 1099 does list income less than 10.

Questions relating to specific tax issues however should be directed to your tax advisor. Ad No Hidden Fees or Minimum Trade Requirements. Or qualified foreign corporation and it is readily tradable on a US.

Wash Sale Cross Account TD Ameritrade and Roth IRA. Information in the Supplemental Information section of the Consolidated Form 1099 is provided for your convenience only. This data can sometimes be cumbersome when served in large quantities but you can export it into Excel or to a printer-friendly page.

TD Ameritrade does not report this income to the IRS. TD Ameritrade Tips for entering your TD Ameritrade 1099-B information into TurboTax. I have their email.

You must enter the gain or loss on sales of securities dividends and interest earned etc. TD Ameritrade does not report this income to the IRS. If you use a Tax Pro you can save your tax preparer time and save tax preparation fees.

What does TD AMERITRADE report to the IRS. TDA will provide you with a form known as a Consolidated. For example I bought 2 options of ticker A on TD Ameritrade on 11202020 for 58 each.

Net Proceeds Box 2a Enter the amount from the statement column Amount Line 2. What does TD Ameritrade report to IRS. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

Does Oanda report to IRS. Then I sold one on 11252020 for a gain 130 the other one I sold for a loss -30 on 11272020. Questions relating to specific tax issues however should be directed to your tax advisor.

Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD Ameritrade is now required as are all broker-dealers to report adjusted cost basis gross proceeds and the holding period when certain securities are sold. The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost basis and holding period on covered securities to the IRS on their Consolidated Form 1099s when securities are sold. 1099-DIV Distributions such as ordinary dividends qualified dividends capital gains and non-taxable distributions that were paid in stock or cash.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. This includes non-taxable payments.

/Fidelityvs.TDAmeritrade-5c61be4546e0fb00017dd69a.png)

Fidelity Investments Vs Td Ameritrade

Td Ameritrade Selective Portfolios Review 2022 A Hybrid Robo Advisor

Pin On 4 Minute Crypto Bitcoin Show

How To Sign Up For A Td Ameritrade Brokerage Account A Step By Step Guide Nasdaq

How To Read Your Brokerage 1099 Tax Form Youtube

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Td Ameritrade Portfolios App How Is A Dividend Received In Td Ameritrade Nikita Gaur

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

What Do The Yellow White Highlights In Cost Basis Gainskeeper Mean R Tdameritrade

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Get Real Time Tax Document Alerts Ticker Tape

Inherited Ira Rmd Calculator Td Ameritrade

Our Td Ameritrade Review How To Get Started Pros Cons And More Navexa

Td Ameritrade Online Brokerages Review 2022 Learnbonds

Td Ameritrade Says I Made 196k In 3 Months R Tax

How To Register A Td Ameritrade Account In Malaysia Marcus Keong